I will be teaching undergraduate environmental economics at UCLA this Winter. In my humble opinion it will be a very good course. For the first time in 7 years, I've actually made some major modifications to the class. Given that my primary appointment is at the UCLA Institute of the Environment, there are always many students who have never taken an economics course before. This subset of students are environmental science majors. While they are quite talented, they are often quite offended by the economist's worldview featuring human's dominance over nature. These students are often surprised that economists do not get philosophical over how humans seized the property rights over nature. We merrily embrace that natural resources belong to us as we decide how to best use this scarce resource. With this in mind, I present you with a "bird's view". Last week the NY Times had a long piece about smelly birds degrading La Jolla, California (home to UCSD) and a beautiful part of the world. Today, there is a letter in the NY Times that I link to above. The author seeks to remind the world that it is tough to be a bird these days. Birds face a variety of challenges that we have unintentionally created for them. The author wants us to have a more inclusive social welfare function defined over all of the world's creatures. I will remember that the next time I see a slug in my driveway.

Switching subjects, did I mention that I have discovered the Fountain of Youth? For those of you who still like to rock out, join me on YouTube and listen to the full length Stones Album "Their Satanic Majesties Request". After not listening to this album for almost 30 years, I am back and have listened to it 5 times today (as I worked!).

Deceived in Dallas, Hoodwinked in Houston and Ambushed in Atlanta

In this new 8 minute YouTube video, I talk through one of the most important insights in modern transportation economics. John Kain and Don Pickrell and Peter Gordon consistently pointed out the bad incentives that urban politicians face for "just saying no" to irreversible, highly costly infrastructure projects. For those who wonder what is the source of my ideas, let me tell you a secret. Listen to this 2005 live Cream concert and your mind will just flow.

Two Interesting Pieces About Real Estate Economics

The WSJ reports that Chinese investors are building residential housing in New York City targeted to Chinese mainland buyers. This doesn't appear to be ethnic favoritism. Instead, the developers want less risk where the risk is that they will build a building that will remain vacant and commitment by Chinese buyers to purchase units both reduces risk for the developer and creates a Chinese community in the new building. This is an example of endogenous attributes in differentiated products. Consider the case of Mercedes cars. If this luxury car was only purchased by losers, would Mercedes be a "great brand"? IO economists are still wrestling with how to model the demand for differentiated products in cases in which the average characteristics of the buyers of a product becomes another attribute of the product. Multiple equilibria can arise in this case. Pat Bayer and Chris Timmins of Duke have studied this problem. See their Economic Journal paper. The Chinese investors have figured out how to exploit this to their advantage.

There is also a piece about Los Angeles real estate focused on Playa Vista. When you land at LAX, you see a huge vacant space with no economic activity. I have often wondered why it didn't fill in with development. This piece focuses on this dynamic. In the past, you could have argued that the airport is noisy and this is a major disamenity. Dan McMillen has documented that new generations of airplanes are much quieter. Quality can offset quality of life challenges in cities! For an example, here is my paper on California air pollution trends.

UPDATE: My short YouTube videos on key ideas in environmental and urban economics are posted here.

There is also a piece about Los Angeles real estate focused on Playa Vista. When you land at LAX, you see a huge vacant space with no economic activity. I have often wondered why it didn't fill in with development. This piece focuses on this dynamic. In the past, you could have argued that the airport is noisy and this is a major disamenity. Dan McMillen has documented that new generations of airplanes are much quieter. Quality can offset quality of life challenges in cities! For an example, here is my paper on California air pollution trends.

UPDATE: My short YouTube videos on key ideas in environmental and urban economics are posted here.

Could Higher Taxes on the 1% Stimulate More Academic Economic Research?

Academic economists are well paid by their universities but many superstar academics do additional consulting. If President Obama raises the marginal tax rate on the high earning economists, some of these economists will act like economists and will substitute away from discretionary consulting as the after tax wage from consulting declines. Assuming the substitution effect dominates the income effect (i.e that labor supply slopes up), these academic stars may actually do MORE academic research. I recognize that they could simply take more leisure but for most academics leisure and academic research are perfect substitutes. If these superstar economists return "to the game" and get the "eye of the tiger" back (think of Rocky III) , economic research progress will accelerate and there will be a positive externality for the academy and for society as a whole. Junior faculty will learn more from their newly engaged senior colleagues and graduate students will learn from the Jedi Masters. The stars had no incentive to internalize this Lucas/Romer externality but the rise in the marginal tax rate helps to correct this market failure.

So, the point of this blog post is that an unintended consequence of raising taxes on the rich will be an acceleration of progress in academic economics. This excites me!

Permit me to make a bad analogy: Abortion is to Consulting as Crime is to Economic Research.

Huh?

Donohue and Levitt famously argued that legalized abortion reduced crime. They argued that a small set of criminals create a large share of crimes. If these folks aren't born then less crime takes place. In the case of academic economics, a small set of economists produce most of the research. If these men and women are diverted into consulting then total research declines sharply. A tax increase has the reverse effect as the stars are nudged back into the game.

UPDATE: I should have noted an implicit economic incidence assumption that I'm making here. In the discussion above, I assumed that the superstar consultants bear the full incidence of the marginal tax increase. I recognize that if their skills are inelastically demanded by law firms and by other firms who employ consultants then these firms will bear the incidence and the superstar consultants will experience no reduction in real wages when the marginal tax increases. If both the superstars and the employers each bear part of the incidence then the academic research community will gain if the superstars have a large elasticity of labor consulting supply as a function of the real after tax consulting wage.

So, the point of this blog post is that an unintended consequence of raising taxes on the rich will be an acceleration of progress in academic economics. This excites me!

Permit me to make a bad analogy: Abortion is to Consulting as Crime is to Economic Research.

Huh?

Donohue and Levitt famously argued that legalized abortion reduced crime. They argued that a small set of criminals create a large share of crimes. If these folks aren't born then less crime takes place. In the case of academic economics, a small set of economists produce most of the research. If these men and women are diverted into consulting then total research declines sharply. A tax increase has the reverse effect as the stars are nudged back into the game.

UPDATE: I should have noted an implicit economic incidence assumption that I'm making here. In the discussion above, I assumed that the superstar consultants bear the full incidence of the marginal tax increase. I recognize that if their skills are inelastically demanded by law firms and by other firms who employ consultants then these firms will bear the incidence and the superstar consultants will experience no reduction in real wages when the marginal tax increases. If both the superstars and the employers each bear part of the incidence then the academic research community will gain if the superstars have a large elasticity of labor consulting supply as a function of the real after tax consulting wage.

Climate Change Adaptation and Shipping Goods on Receding Rivers

The NY Times reports that the great drought is causing the Mississippi River to retreat and this means that big boats can't use it to ship goods because they will hit the ground on the bottom of the river. As the self appointed world's leading optimist about how capitalism evolves to help us cope with climate change's consequences, permit me to offer a few thoughts.

First, let's not forget increasing returns to scale. The shippers of fertilizer and other products are attracted to shipping products to final consumers using this river because the transport cost per $ of sales is low. If the option of shipping by boat vanishes, and no rail road tracks are around, how will fertilizer sellers adjust? Truckers and smaller boats will fill the void and the profits of fertilizer sellers will fall and the price per pound of fertilizer will rise. Who bears the incidence of this shock depends on the elasticity of these supply and demand curves.

Let me point out a silver lining from this climate change induced effect. I predict that farmers will use less fertilizer in the Midwest as the price rises and the nitrogen cycle problems and the Dead Zone in the Gulf of Mexico will be partially mitigated. Farmers will figure out how to grow output with less fertilizer. For environmentalists who haven't studied general equilibrium theory, this is an obvious prediction from standard supply and demand models.

History doesn't have to repeat itself. Just because farmers are used to buying their fertilizer from some guy who shipped it on this River doesn't mean that in the future this pattern must persist. Perhaps this shock will give a boost to organic farmers who don't use synthetic fertilizers.

For you environmental economists, note that I'm making a Porter Hypothesis style point. In the Porter Hypothesis, regulation nudges profit maximizers to take a fresh look at their business choices and some of them discover new approaches that lower their cost of production. In a similar spirit, I'm arguing here that climate shocks shake up the status quo and force firms within the farming industry to re-optimize. In a diverse world, some will be more nimble than others but I don't care about such distributional effects. The winner of this adaptation competition will have good produce for us and we will eat it.

First, let's not forget increasing returns to scale. The shippers of fertilizer and other products are attracted to shipping products to final consumers using this river because the transport cost per $ of sales is low. If the option of shipping by boat vanishes, and no rail road tracks are around, how will fertilizer sellers adjust? Truckers and smaller boats will fill the void and the profits of fertilizer sellers will fall and the price per pound of fertilizer will rise. Who bears the incidence of this shock depends on the elasticity of these supply and demand curves.

Let me point out a silver lining from this climate change induced effect. I predict that farmers will use less fertilizer in the Midwest as the price rises and the nitrogen cycle problems and the Dead Zone in the Gulf of Mexico will be partially mitigated. Farmers will figure out how to grow output with less fertilizer. For environmentalists who haven't studied general equilibrium theory, this is an obvious prediction from standard supply and demand models.

History doesn't have to repeat itself. Just because farmers are used to buying their fertilizer from some guy who shipped it on this River doesn't mean that in the future this pattern must persist. Perhaps this shock will give a boost to organic farmers who don't use synthetic fertilizers.

For you environmental economists, note that I'm making a Porter Hypothesis style point. In the Porter Hypothesis, regulation nudges profit maximizers to take a fresh look at their business choices and some of them discover new approaches that lower their cost of production. In a similar spirit, I'm arguing here that climate shocks shake up the status quo and force firms within the farming industry to re-optimize. In a diverse world, some will be more nimble than others but I don't care about such distributional effects. The winner of this adaptation competition will have good produce for us and we will eat it.

Benevolent Paternalists vs. Tough Love: The Case of Climate Change Adaptation

This is a blog post about climate adaptation and a spatial separating equilibrium played out in a sequential game. In this game, government must make a choice to either embrace benevolent paternalism or engage in tough love. There are two types of people. One type is called "Mr. Spock" and the other is called "Homer Simpson". After government has chosen its actions and after each type has chosen its action, Mother Nature then makes a move (a Hurricane Sandy or no Sandy) and payoffs are observed.

To keep this non-peer reviewed blog post short, I assume that a person's type is exogenously determined and that 50% of the population are Spock and 50% of the population are Homer. The Mr. Spocks are 'University of Chicago" rational expectations men and women who form actuarial probabilities over random variables. The Homer Simpsons are UC Berkeley behavioral economics people who are naive and do not update their probabilities of disaster as new information about climate change arrives.

The Chronology of this game is the following;

1. Government chooses to defend the coast or not.

2. People choose whether to live on the coast or not

3. Mother Nature chooses to inflict a "Hurricane Sandy" on the coast.

Case #1: A Low Cost Adaptation Equilibrium:

Government chooses to not defend the coast.

The Spocks are risk averse and aware of the risks that the coastal city faces and they move to the "Higher Ground" safe city. (We could make this model fancier if we allowed the Spocks and Homers to differ with respect to their love of living near the coast. In this case, the subset of Spocks who love coastal living might live there even as the climate risk increases).

The Homers are naive but they know that the Spocks are smart and they engage in Banjeree herding and follow Spocks to Higher Ground.

In this case, regardless of whether Mother Nature inflicts a Sandy, no real damage is caused because

of the private self protection of migrating to the safe city. The losers in this case are the land owners in the coastal city who will suffer a loss in asset value as aggregate demand falls.

Case #2: The Darwin Equilibrium (the spatial separating equilibrium)

Government chooses to not defend the coast.

The Spocks are risk averse and they move to the "Higher Ground" safe city.

The Homers drink their beer and ignore the pending danger and remain in the pretty coastal city.

In this case, if Mother Nature doesn't inflict pain, the Homers laugh at the Al Goreish Spocks for being Chicken Littles. If a nasty Sandy Storm does take place, the Homers suffer and the Spocks repopulate the planet.

Fear of Equilibrium #2 nudges the benevolent paternalists to invest national $ to protect the coastal areas in step #1. This nudges some Spocks to remain in the coastal area and this is the moral hazard margin.

Case #3: Climatopolis Logic

Critics of my Climatopolis book have argued that I believe in "every man for himself" in a sort of law of the jungle. This is false. I want men and women to use decentralized free markets (where people do interact) to work to help folks to adapt.

If the Spocks anticipate that the Homers have placed themselves at risk by ignoring the increased risk of a major Sandy Storm, then out of entrepreneurial self interest, they have strong incentives to develop products to help the Homers live on in their risky coastal area. Depending on the timing of how the shocks arrive, these Homers will have the time and motivation to purchase such products. This is endogenous innovation at work as an adaptation tool. Researchers and environmentalists have not explored this channel.

If the "Homers" are too silly to recognize that they have made a risky choice that is growing riskier over time, then the Red Cross and other volunteer groups can work to help to protect this group. The key issue here is whose $ is used to protect this group? I do support benevolent paternalism in terms of using the zoning code to discourage individuals from living in the riskiest areas. We are about to face a very interesting case of "buyer beware". Do you view adults to be adults and thus responsible for their decisions?

In the second economy I presented above the Homers who live in the coastal city have their lifestyle subsidized by the Spocks who live in the safe city and pay national taxes. The government Sea Walls are funded with national (not local) tax dollars. When people go bungee jumping, do they expect a similar subsidy? What is the difference between these different risk categories?

To keep this non-peer reviewed blog post short, I assume that a person's type is exogenously determined and that 50% of the population are Spock and 50% of the population are Homer. The Mr. Spocks are 'University of Chicago" rational expectations men and women who form actuarial probabilities over random variables. The Homer Simpsons are UC Berkeley behavioral economics people who are naive and do not update their probabilities of disaster as new information about climate change arrives.

The Chronology of this game is the following;

1. Government chooses to defend the coast or not.

2. People choose whether to live on the coast or not

3. Mother Nature chooses to inflict a "Hurricane Sandy" on the coast.

Case #1: A Low Cost Adaptation Equilibrium:

Government chooses to not defend the coast.

The Spocks are risk averse and aware of the risks that the coastal city faces and they move to the "Higher Ground" safe city. (We could make this model fancier if we allowed the Spocks and Homers to differ with respect to their love of living near the coast. In this case, the subset of Spocks who love coastal living might live there even as the climate risk increases).

The Homers are naive but they know that the Spocks are smart and they engage in Banjeree herding and follow Spocks to Higher Ground.

In this case, regardless of whether Mother Nature inflicts a Sandy, no real damage is caused because

of the private self protection of migrating to the safe city. The losers in this case are the land owners in the coastal city who will suffer a loss in asset value as aggregate demand falls.

Case #2: The Darwin Equilibrium (the spatial separating equilibrium)

Government chooses to not defend the coast.

The Spocks are risk averse and they move to the "Higher Ground" safe city.

The Homers drink their beer and ignore the pending danger and remain in the pretty coastal city.

In this case, if Mother Nature doesn't inflict pain, the Homers laugh at the Al Goreish Spocks for being Chicken Littles. If a nasty Sandy Storm does take place, the Homers suffer and the Spocks repopulate the planet.

Fear of Equilibrium #2 nudges the benevolent paternalists to invest national $ to protect the coastal areas in step #1. This nudges some Spocks to remain in the coastal area and this is the moral hazard margin.

Case #3: Climatopolis Logic

Critics of my Climatopolis book have argued that I believe in "every man for himself" in a sort of law of the jungle. This is false. I want men and women to use decentralized free markets (where people do interact) to work to help folks to adapt.

If the Spocks anticipate that the Homers have placed themselves at risk by ignoring the increased risk of a major Sandy Storm, then out of entrepreneurial self interest, they have strong incentives to develop products to help the Homers live on in their risky coastal area. Depending on the timing of how the shocks arrive, these Homers will have the time and motivation to purchase such products. This is endogenous innovation at work as an adaptation tool. Researchers and environmentalists have not explored this channel.

If the "Homers" are too silly to recognize that they have made a risky choice that is growing riskier over time, then the Red Cross and other volunteer groups can work to help to protect this group. The key issue here is whose $ is used to protect this group? I do support benevolent paternalism in terms of using the zoning code to discourage individuals from living in the riskiest areas. We are about to face a very interesting case of "buyer beware". Do you view adults to be adults and thus responsible for their decisions?

In the second economy I presented above the Homers who live in the coastal city have their lifestyle subsidized by the Spocks who live in the safe city and pay national taxes. The government Sea Walls are funded with national (not local) tax dollars. When people go bungee jumping, do they expect a similar subsidy? What is the difference between these different risk categories?

The Environmental Consequences of Urban Growth in Brazil's Amazon

Academic geographers use remote sensing techniques to measure the "footprint" of growing cities. From outer space, you can identify how much land area a metropolitan area such as Cairo or Boston takes up and how this changes over time. Researchers such as Yale's Karen Seto track these footprints.

Today's NY Times has an article focused on urban growth in the Amazon Brazil's new cities. In this case, there is a significant global environmental externality associated with urban growth. Why? Don't forget the concept of opportunity cost. The land that is urbanized used to be tropical forests and these forests sequester significant amounts of carbon dioxide and this reduces global GHG emissions. As these cities grow, a type of increasing returns to scale takes place and such growth may stimulate even more growth. This is likely if the growing cities have increased political clout and can attract national subsidies for new infrastructure such as roads.

Given that there is a global negative externality associated with Amazon urban growth, what is good public policy? Should the United Nations collect global funds and pay the Brazilian government to encourage urbanization away from the Amazon? Should the UN help the Amazon cities to grow vertically so that their land footprint doesn't grow? Cities such as Singapore and Hong Kong have shown how millions can be stacked in relatively small land areas. Have urban planners in LDC nations been thinking about how to build vertical cities so that the city can achieve the win-win of urban growth without embodying a large land footprint?

The incentive problem here is the property rights and protection for the Amazon's forests. These are global public goods. If these were private property, the owner would internalize the $ benefits the world enjoys from carbon sequestration and he would be paid for these benefits. Right now, the world is free riding on Brazil and the self interested urbanites in these growing cities have no incentive to internalize the externality their urban growth causes. Public property gets trampled. Even hippies now understand why we need fences.

Today's NY Times has an article focused on urban growth in the Amazon Brazil's new cities. In this case, there is a significant global environmental externality associated with urban growth. Why? Don't forget the concept of opportunity cost. The land that is urbanized used to be tropical forests and these forests sequester significant amounts of carbon dioxide and this reduces global GHG emissions. As these cities grow, a type of increasing returns to scale takes place and such growth may stimulate even more growth. This is likely if the growing cities have increased political clout and can attract national subsidies for new infrastructure such as roads.

Given that there is a global negative externality associated with Amazon urban growth, what is good public policy? Should the United Nations collect global funds and pay the Brazilian government to encourage urbanization away from the Amazon? Should the UN help the Amazon cities to grow vertically so that their land footprint doesn't grow? Cities such as Singapore and Hong Kong have shown how millions can be stacked in relatively small land areas. Have urban planners in LDC nations been thinking about how to build vertical cities so that the city can achieve the win-win of urban growth without embodying a large land footprint?

The incentive problem here is the property rights and protection for the Amazon's forests. These are global public goods. If these were private property, the owner would internalize the $ benefits the world enjoys from carbon sequestration and he would be paid for these benefits. Right now, the world is free riding on Brazil and the self interested urbanites in these growing cities have no incentive to internalize the externality their urban growth causes. Public property gets trampled. Even hippies now understand why we need fences.

Rational Expectations and Low Probability Events

Self interested people have an incentive to form their best guesses about the probabilities and impacts of different future scenarios. Climate change poses some trouble here because it creates a "non-stationarity" in the sense that the random variables (the impacts of climate change) have means and standard deviations that change over time. Intuitively, how do you plan to hit a moving target? If the bullseye target never moves, where your darts land is still a random variable but you know how to practice. How do we adapt as the target moves? Professor Rumsfeld has taught us that when you "know that you don't know" what to expect, the prudent person builds some slack into their decision so that they don't regret their choice some time in the future.

With this background, let's consider two pieces in today's NY Times. First, we hear from the President of Tulane University. Universities are place based and his University is in New Orleans. He has strong incentives to argue that his University (which was horribly injured by Katrina) is back and is robust in the face of the next storm.

Source:

In my Climatopolis, I argue that it is fine for New Orleans to rebuild if the investors there use their own $. President Cowen forgets that billions of federal tax payer dollars were used to rebuild his University's city. That's bad incentives.

Note that at the end of his letter he engages in some public relations to signal to outsiders that New Orleans is now safe. I hope he is right.

A more salient and optimistic example of rational expectations is provided in this piece . The boss of this firm was prudent enough to build his key floors 4 feet higher to reduce flood risk. Here is a quote that highlights how we will adapt to climate change:

This case study highlights the key adaptation recipe. Note that if we are "behavioral agents" who do not engage in forward planning then we have a problem. Such individuals will not have taken the precautions that Sims Metal Management took. This point has not been discussed by academic economists but in my Climatopolis I argued that climate change planning poses the ultimate test for distinguishing whether neo-classical economists or behavioral economists have the right model of predicting human behavior. The "doom and gloomers" embrace both a behavioral economics view of individual rationality and a benevolent paternalistic view of government. That's quite a statement.

UPDATE: Contrast the company I discussed above, with the New Jersey Transit Authority. Here is my source and here is a quote:

"Less than a month after Hurricane Sandy damaged nearly a quarter of its rail cars and locomotives, New Jersey Transit is facing withering criticism this week for keeping much of its equipment in low-lying yards during the storm, despite forecasts of potential flooding."

Do you have to be a genius to think about choosing another site for the rail cars? A cynic might ask if the NJT would have been more likely to have figured this out ex-ante if it had been using its own $ rather than tax payer $. Moral hazard lurks and the absence of moral hazard (i.e using your own $) tends to focus the mind!!

You don't have to be Darwin to see that forward looking companies and decision makers will be rewarded by Mother Nature for being smart. This is evolutionary capitalism at work. Sink or swim sounds rough but such "tough love" creates strong incentives to change your game and adapt.

With this background, let's consider two pieces in today's NY Times. First, we hear from the President of Tulane University. Universities are place based and his University is in New Orleans. He has strong incentives to argue that his University (which was horribly injured by Katrina) is back and is robust in the face of the next storm.

Source:

To the Editor:

Orrin H. Pilkey (“We Need to Retreat From the Beach,” Op-Ed, Nov. 15) makes what appears to be a reasonable argument against rebuilding shorelines or homes near the beach destroyed by Hurricane Sandy. Unfortunately, this is reminiscent of what New Orleanians heard after Hurricane Katrina: Why rebuild New Orleans, because it will always be prone to flooding?

Since when did our country develop a standard that we abandon places prone to repeat disasters? People live in danger zones knowing that danger may strike again: San Francisco sits on a fault line, much of New Orleans is built below sea level, and the Eastern seaboard is a flood zone.

In every case, community feeling and the attachment to home has trumped scientific facts and urban planning.

The “resilient development” Mr. Pilkey refers to as a less good alternative to “retreat” can work. New Orleans and neighborhoods like the Lower Ninth Ward exist today because of significant improvements in their flood protection system, proving that the art of the possible can work.

SCOTT COWEN

President, Tulane University

New Orleans, Nov. 19, 2012

President, Tulane University

New Orleans, Nov. 19, 2012

In my Climatopolis, I argue that it is fine for New Orleans to rebuild if the investors there use their own $. President Cowen forgets that billions of federal tax payer dollars were used to rebuild his University's city. That's bad incentives.

Note that at the end of his letter he engages in some public relations to signal to outsiders that New Orleans is now safe. I hope he is right.

A more salient and optimistic example of rational expectations is provided in this piece . The boss of this firm was prudent enough to build his key floors 4 feet higher to reduce flood risk. Here is a quote that highlights how we will adapt to climate change:

"But the real storm preparations had been accomplished six years earlier, when Sims Metal Management approved a design for a state-of-the-art city recycling plant that is rising at the South Brooklyn Marine Terminal.

Reviewing projections for local sea-level rise, the company and its architects decided to elevate portions of the site to heights exceeding city requirements by four feet. Using recycled glass and crushed rock discarded from projects like the Second Avenue subway line, they raised the foundation for the plant’s four buildings and a dock.

The fill added $550,000 to the plant’s costs of around $100 million, said Thomas Outerbridge, Sims Metal’s general manager.

But it proved more than worth it. When a 12-foot storm surge swept through nearby streets and parking lots on Oct. 29, the plant’s dock and partly completed buildings did not flood.

“It paid for itself long before we expected it,” Mr. Outerbridge said. “It was built with the idea that, over the next 40 years, this would prove a prudent thing — and the proof came during construction.”

This case study highlights the key adaptation recipe. Note that if we are "behavioral agents" who do not engage in forward planning then we have a problem. Such individuals will not have taken the precautions that Sims Metal Management took. This point has not been discussed by academic economists but in my Climatopolis I argued that climate change planning poses the ultimate test for distinguishing whether neo-classical economists or behavioral economists have the right model of predicting human behavior. The "doom and gloomers" embrace both a behavioral economics view of individual rationality and a benevolent paternalistic view of government. That's quite a statement.

UPDATE: Contrast the company I discussed above, with the New Jersey Transit Authority. Here is my source and here is a quote:

"Less than a month after Hurricane Sandy damaged nearly a quarter of its rail cars and locomotives, New Jersey Transit is facing withering criticism this week for keeping much of its equipment in low-lying yards during the storm, despite forecasts of potential flooding."

Do you have to be a genius to think about choosing another site for the rail cars? A cynic might ask if the NJT would have been more likely to have figured this out ex-ante if it had been using its own $ rather than tax payer $. Moral hazard lurks and the absence of moral hazard (i.e using your own $) tends to focus the mind!!

You don't have to be Darwin to see that forward looking companies and decision makers will be rewarded by Mother Nature for being smart. This is evolutionary capitalism at work. Sink or swim sounds rough but such "tough love" creates strong incentives to change your game and adapt.

Back to Work!

Three days on the beach in Carpinteria, California is a good way to clear one's mind. While there was some fog today, the other two days featured blue skies and 70 degree days. For a guy from NYC, I'm not used to that weather in late November.

For those of you who don't live in California, this photo will provide some insights into the view and the life.

With my three days on the beach now behind me, I'm ready to work. I will fly to Boston in early December and this will provide me with a sense of what I'm missing on the other coast.

For those of you who don't live in California, this photo will provide some insights into the view and the life.

With my three days on the beach now behind me, I'm ready to work. I will fly to Boston in early December and this will provide me with a sense of what I'm missing on the other coast.

Hard Money Loan #22 Getting Paid Off

I received word yesterday that Hard Money Loan #22 is scheduled to be paid off the first week of December. No details on the sale. In fact, it's been 1 year since the loan was made, so it's possible this is a refi and not a sale at all. The property was a triplex with renters in place who wanted to stay, so it's possible the buyer is going to keep it himself.

I'll also take this opportunity to take the interest I received from this loan and add it to the principal for my next one. Manual compounding, if you will..

I'll also take this opportunity to take the interest I received from this loan and add it to the principal for my next one. Manual compounding, if you will..

The NY Times Discusses Climate Change Adaptation

There are three very good articles in today's NY Times focused on climate change adaptation. First, there is an article on how to use solar power as a backup electricity provision technology when power lines fall down. Second, the Arts section discusses several ideas related to flood barriers. Finally, the Science Section discusses engineering solutions using balloons to protect the under ground subways from future flooding. I see endogenous innovation and experimentation taking place. This is the "small ball" of climate change adaptation. This is the "micro foundation" for how our cities will continue to thrive in our hotter future.

The World Bank Ignores How Capitalism Can Help Us to Adapt to Climate Change!

The World Bank's core mission is to foster equitable economic growth in the developing world. I have always assumed that its research team were fans of free markets and capitalism's amazing ability to provide opportunities and possibilities. But, I have now read this report on climate change's impacts and I can't find a single sentence focused on how capitalism will help LDC nations to adapt to climate change. Strange! It is also noteworthy that Section 6 (which focuses on sectoral impacts) discusses Agriculture, Water Resources, Ecosystems and Biodiversity, and Human Health but skips urbanization! Yet in 15 years, over 60% of the world's population will be living in cities.

International trade in goods, ideas, agricultural products, capital and labor will help many nations to adapt to the new climate realities. I have spoken at the World Bank about these topics but apparently my work has not influenced the Bank's thinking on this topic. I will repeat again my key thought. The World Bank should focus on supporting free international markets and then it can be more confident that the costs of climate change will be lower.

As I read this WB document, I see a science document with no discussion of how the 7 billion self interested people on the planet will respond to the "news" embodied in this report. The anticipation of a challenge gives rise to ex-ante investments and coping strategies that mitigate the sting of the blow. Intuitively, if you see the punch coming you duck! At least based on this publication, the World Bank views the developing world as passive victims here. Here is a direct quote from the piece:

"Largely beyond the scope of this report are the far-reaching and

uneven adverse implications for poverty in many regions arising

from the macroeconomic consequences of shocks to global agricultural production from climate change. It is necessary to stress here that even where overall food production is not reduced or is even increased with low levels of warming, distributional issues mean that food security will remain a precarious matter or worsen as different regions are impacted differently and food security is further challenged by a multitude of nonclimatic factors."

I will let you explain to me what this vague paragraph means.

A brief examination of the references to the report indicates that only 4 economists are cited in this report. I congratulate Josh, Matt, Wolfram and Michael for being cited here!

Schlenker, W., & Roberts, M. J. (2009). Nonlinear temperature

effects indicate severe damages to U.S. crop yields under

climate change. Proceedings of the National Academy of Sciences, 106(37), 15594–15598. doi:10.1073/pnas.0906865106

Zivin, J. G., & Neidell, M. J. (2010). Temperature and the Allocation

of Time: Implications for Climate Change. Cambridge, MA.

Retrieved from http://www.nber.org/papers/w15717

Apparently 200 years of economics research has yielded only 2 relevant papers on this subject! Interesting!

To my many friends at the World Bank I must ask, given how many talented Ph.D. economists you have on payroll, do any of you have anything to say about applying basic logic from microeconomics to thinking about climate change adaptation? I know that you can buy a cheap copy of Climatopolis on Amazon. Should I subsidize such a mass purchase?

International trade in goods, ideas, agricultural products, capital and labor will help many nations to adapt to the new climate realities. I have spoken at the World Bank about these topics but apparently my work has not influenced the Bank's thinking on this topic. I will repeat again my key thought. The World Bank should focus on supporting free international markets and then it can be more confident that the costs of climate change will be lower.

As I read this WB document, I see a science document with no discussion of how the 7 billion self interested people on the planet will respond to the "news" embodied in this report. The anticipation of a challenge gives rise to ex-ante investments and coping strategies that mitigate the sting of the blow. Intuitively, if you see the punch coming you duck! At least based on this publication, the World Bank views the developing world as passive victims here. Here is a direct quote from the piece:

"Largely beyond the scope of this report are the far-reaching and

uneven adverse implications for poverty in many regions arising

from the macroeconomic consequences of shocks to global agricultural production from climate change. It is necessary to stress here that even where overall food production is not reduced or is even increased with low levels of warming, distributional issues mean that food security will remain a precarious matter or worsen as different regions are impacted differently and food security is further challenged by a multitude of nonclimatic factors."

I will let you explain to me what this vague paragraph means.

A brief examination of the references to the report indicates that only 4 economists are cited in this report. I congratulate Josh, Matt, Wolfram and Michael for being cited here!

Schlenker, W., & Roberts, M. J. (2009). Nonlinear temperature

effects indicate severe damages to U.S. crop yields under

climate change. Proceedings of the National Academy of Sciences, 106(37), 15594–15598. doi:10.1073/pnas.0906865106

Zivin, J. G., & Neidell, M. J. (2010). Temperature and the Allocation

of Time: Implications for Climate Change. Cambridge, MA.

Retrieved from http://www.nber.org/papers/w15717

Apparently 200 years of economics research has yielded only 2 relevant papers on this subject! Interesting!

To my many friends at the World Bank I must ask, given how many talented Ph.D. economists you have on payroll, do any of you have anything to say about applying basic logic from microeconomics to thinking about climate change adaptation? I know that you can buy a cheap copy of Climatopolis on Amazon. Should I subsidize such a mass purchase?

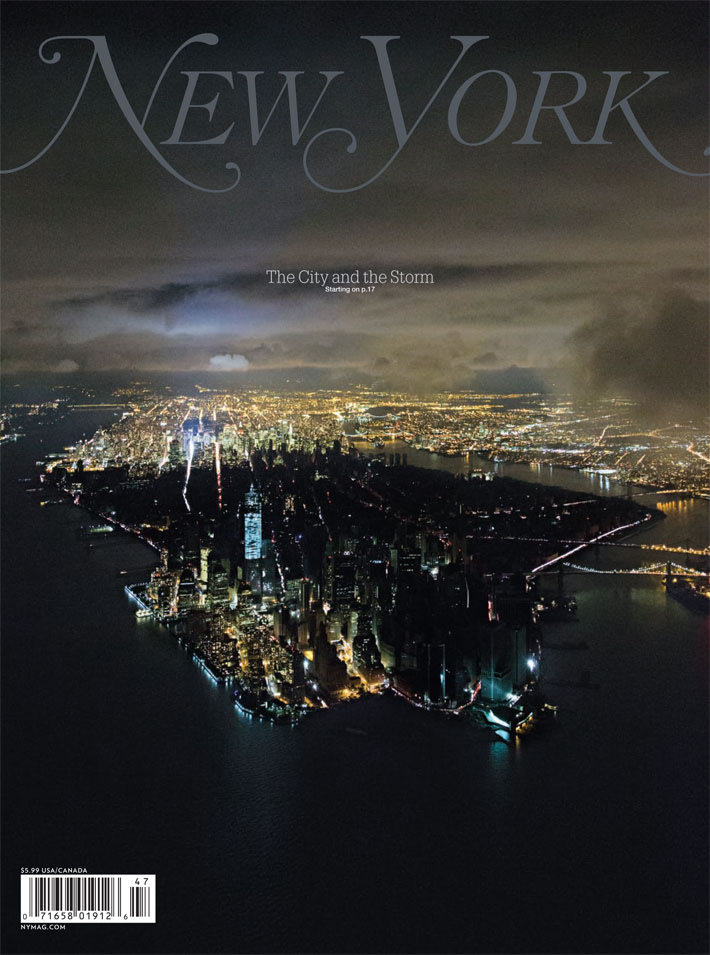

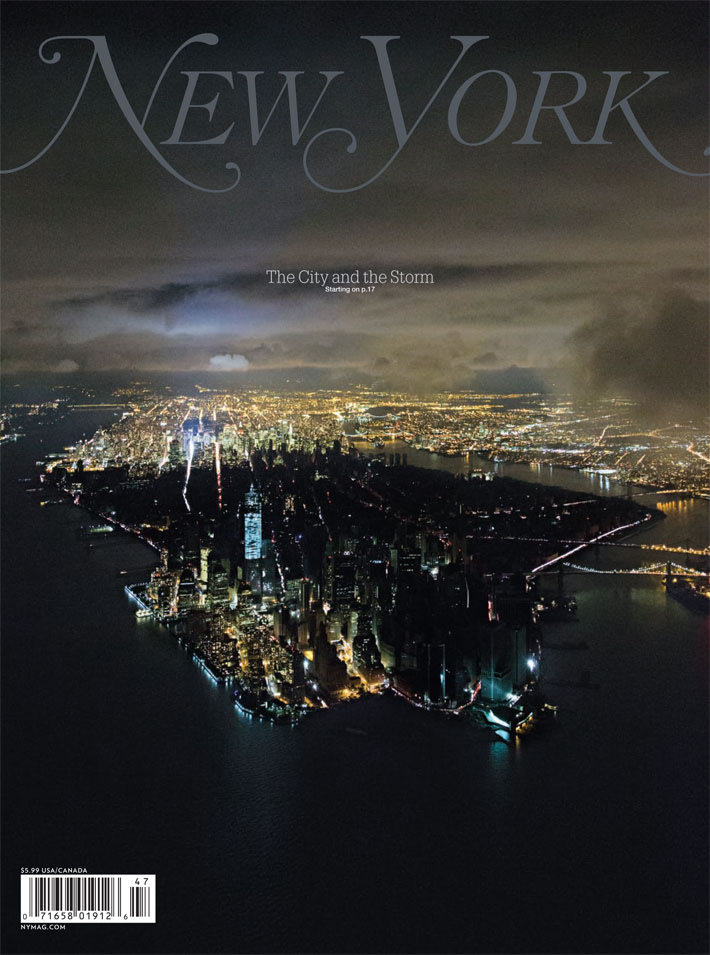

The Spatial Distribution of Deaths in the NYC Region Caused by Sandy

For young geographers, here is a useful map. I see certain obvious geographical patterns in these maps. Those who are risk averse must move to higher ground. Urban economists have consistently argued that urban zoning laws must be changed to allow for more high rise construction. Such a strategy would create urban living opportunities in safer parts of coastal cities.

We will see if Sandy is a "salient shock". Life appears to be getting back to normal. I see that NYU's downtown campus is up and running and that this south of 39th Street school is holding an interesting conference on what are the lessons from Sandy.

We will see if Sandy is a "salient shock". Life appears to be getting back to normal. I see that NYU's downtown campus is up and running and that this south of 39th Street school is holding an interesting conference on what are the lessons from Sandy.

The Coase Theorem Applies on 'Amtrak's Quiet Cars

For those of you who worry that our civilization is crumbling, read this NY Times piece about life on the quiet car on Amtrak. You will be introduced to a place that is supposed to be quiet where rules of the game are set and people are supposed to follow them. Not everyone follows these rules as they endlessly gab away on their cell phones. The author tells a funny true story of how "rational men" figure out adaptation strategies to minimize the social cost of noise externalities (he doesn't use these words).

Here are the key quotes:

Here are the key quotes:

"“I’m not talking about cellphone conversations,” he said, “I’m talking about your typing, which really is very loud and disruptive.”

I was at a loss. I learned to write on a typewriter, and apparently I still strike the keyboard of my laptop with obsolete force. “Well,” I said, trying to figure out which of us, if either, was the jerk here, “I don’t think I’m going to stop typing. I’m a writer; I sit in here so I can work.”

He was polite but implacable. “If you won’t stop, I’ll have to talk to the conductor,” he said.

Looking around, I saw that the Quiet Car wasn’t crowded; there were plenty of empty seats. “I’m not going to leave the Quiet Car,” I told him, “but since it’s bothering you, I will move to another seat.” He thanked me very courteously, as did the woman in front of me. “It really was quite loud,” she whispered.

When the train came to my stop I had to walk by his seat again on my way out. “Glad we could come to a peaceful coexistence,” I said as I passed. He raised a finger to stay me a moment. “There are no conflicts of interest,” he pronounced, “between rational men.” This sounded like a questionable proposition to me, but I appreciated the conciliatory gesture. The quote turns out to be from Ayn Rand. I told you we talked like this in the Quiet Car."

Indoctrination at Research Universities?

Are young people susceptible to new ideas? I'm not so sure. In my 22 years teaching undergraduates, I've met some dogmatic Bayesians who were not eager to update their view of the world. Hopefully somebody is at the margin! Given that liberal faculty are the majority on many campuses not named UC Berkeley, do Conservatives have a legitimate fear of powerful treatment effects? You do recall that I blogged about this hypothesis in 2010 in this classic post about Yale Law School?

In this recent blog post, Peter Wood revisits the issue of the fundamental asymmetry of ideology in U.S universities. He points out that at FSU that a donation of funds to create a Koch Chair in Political Economy almost caused a riot while at UCLA recent small grants to encourage the faculty to introduce "sustainability" into their course material has been celebrated.

What do I think? If Mr. Koch wants to give a chair in "free market environmentalism" to UCLA --- I would be thrilled. Scholars who are "for hire" will quickly face ridicule from their peers. Active scholars can self police themselves through the rigorous peer review process for academic papers. A scholar who held a "Koch Chair" might expect to give some after dinner remarks at meetings of "fat cats" but that sounds like fun! Such a scholar might write provocative blog posts and editorials but isn't that good? What happened to the competition of ideas? If such a scholar tried to publish a provocative idea with minimal evidence in a serious outlet, it will be rejected during peer review.

Turning to UCLA's small grants for nudging sustainability forward; here is a direct quote from Peter Wood's blog;

"UCLA has found a novel way to improve the politicization of its curriculum. UCLA Today, the faculty and staff newspaper, reports that the university's Institute of the Environment and Sustainability and the Sustainability Committee have teamed up to help faculty members across the university figure out ways to slip sustainability messages into their classes, regardless of the actual subjects they are teaching. Participating faculty members get a two-hour workshop and a $1,200 grant to turn their courses into vehicles of sustaina-ganda."

This quote is funny but it is over the top. If Peter Wood did his homework (and looked at my record and what Magali Delmas works on), he would know that there is "ideological balance" at UCLA's Institute of the Environment. We are a center of free market environmentalism.

The small grants program is really a "Sunstein and Thaler style" nudge to get older faculty to take a new look at their lecture notes. When I think back to the classes I took in College, there weren't many synergies between them. The broad theme of "sustainability" does cross many disciplines. To UCLA's credit, we are thinking about how to improve our product. As we raise our tuition, we owe it to the students to think through whether we can produce a better undergraduate experience.

As a tenured member of the UCLA Institute of the Environment (and as a proud 1993 graduate of the University of Chicago's Ph.D program), I can solemnly swear that we do not have a "politicized curriculum". I do worry that many young people have strange naive negative views of free market competitive capitalism (as they happily use their laptop computer and login to Facebook and drink their Starbucks coffee) but this means that they need to learn more about what their life would have been like under alternative societal rules such as those introduced by Mao and Stalin. Our students often do believe in benevolent, productive government. On that score, I hope they are right but we need to take a sober look at the evidence.

In this recent blog post, Peter Wood revisits the issue of the fundamental asymmetry of ideology in U.S universities. He points out that at FSU that a donation of funds to create a Koch Chair in Political Economy almost caused a riot while at UCLA recent small grants to encourage the faculty to introduce "sustainability" into their course material has been celebrated.

What do I think? If Mr. Koch wants to give a chair in "free market environmentalism" to UCLA --- I would be thrilled. Scholars who are "for hire" will quickly face ridicule from their peers. Active scholars can self police themselves through the rigorous peer review process for academic papers. A scholar who held a "Koch Chair" might expect to give some after dinner remarks at meetings of "fat cats" but that sounds like fun! Such a scholar might write provocative blog posts and editorials but isn't that good? What happened to the competition of ideas? If such a scholar tried to publish a provocative idea with minimal evidence in a serious outlet, it will be rejected during peer review.

Turning to UCLA's small grants for nudging sustainability forward; here is a direct quote from Peter Wood's blog;

"UCLA has found a novel way to improve the politicization of its curriculum. UCLA Today, the faculty and staff newspaper, reports that the university's Institute of the Environment and Sustainability and the Sustainability Committee have teamed up to help faculty members across the university figure out ways to slip sustainability messages into their classes, regardless of the actual subjects they are teaching. Participating faculty members get a two-hour workshop and a $1,200 grant to turn their courses into vehicles of sustaina-ganda."

This quote is funny but it is over the top. If Peter Wood did his homework (and looked at my record and what Magali Delmas works on), he would know that there is "ideological balance" at UCLA's Institute of the Environment. We are a center of free market environmentalism.

The small grants program is really a "Sunstein and Thaler style" nudge to get older faculty to take a new look at their lecture notes. When I think back to the classes I took in College, there weren't many synergies between them. The broad theme of "sustainability" does cross many disciplines. To UCLA's credit, we are thinking about how to improve our product. As we raise our tuition, we owe it to the students to think through whether we can produce a better undergraduate experience.

As a tenured member of the UCLA Institute of the Environment (and as a proud 1993 graduate of the University of Chicago's Ph.D program), I can solemnly swear that we do not have a "politicized curriculum". I do worry that many young people have strange naive negative views of free market competitive capitalism (as they happily use their laptop computer and login to Facebook and drink their Starbucks coffee) but this means that they need to learn more about what their life would have been like under alternative societal rules such as those introduced by Mao and Stalin. Our students often do believe in benevolent, productive government. On that score, I hope they are right but we need to take a sober look at the evidence.

The Venn Diagram

Ed Glaeser has argued that the whole world's population could comfortably live in a land area the size of Texas. Presumably, their food would be grown somewhere else? In my talks with reporters about Sandy, I have touched on the idea of the "Venn Diagram".

In the 21st century, the vast majority of us will live in cities. We need to build these cities in places that are;

1. pretty (amenities)

2. safe (climate resilient)

3. productive (economize on transportation costs to input suppliers and final consumers)

These are the three circles that form the venn diagram. What is the overlap area of these three? You should buy real estate in those places and wait! One of the ideas in my Climatopolis is that in the absence of activist moral hazard federal government investment, economic activity will naturally gravitate to the overlap area of this Venn diagram. This is the invisible hand at work and this is how we adapt to climate change. Federal government investment in "climate proofing" risky areas actually slows down this neo-classical adjustment process. We are always rebuilding our cities. If you currently own real estate in areas not located in the Venn Diagram overlap area, you have my sympathy but the first idea of diversification and asset allocation is to avoid putting all of your eggs in one basket.

In the 21st century, the vast majority of us will live in cities. We need to build these cities in places that are;

1. pretty (amenities)

2. safe (climate resilient)

3. productive (economize on transportation costs to input suppliers and final consumers)

These are the three circles that form the venn diagram. What is the overlap area of these three? You should buy real estate in those places and wait! One of the ideas in my Climatopolis is that in the absence of activist moral hazard federal government investment, economic activity will naturally gravitate to the overlap area of this Venn diagram. This is the invisible hand at work and this is how we adapt to climate change. Federal government investment in "climate proofing" risky areas actually slows down this neo-classical adjustment process. We are always rebuilding our cities. If you currently own real estate in areas not located in the Venn Diagram overlap area, you have my sympathy but the first idea of diversification and asset allocation is to avoid putting all of your eggs in one basket.

Clear and Present Danger

Does the expected utility model explain why some individuals choose to not evacuate an at risk area as a natural disaster approaches? A silver lining of Hurricane Sandy is that its salience guarantees that future storms will cause fewer deaths because more people will obey future evacuation orders. This is one margin of adaptation. The "small ball" of adaptation will involve dozens of steps that together will allow cities to continue to thrive in the face of increased natural disaster risk.

Many people believe that we are "doomed" because of climate change. I reject this pessimism. Self interested people and firms who anticipate a threat have strong incentives to protect themselves through a broad set of strategies. Of course carbon pricing is the first best strategy but that ain't going to happen at the national or international level.

I just received this email that suggests that literature may help us to adapt to climate change. This claim may be true. Curious about what in the heck is the basis for her claim, I found this podcast of hers. I have not listened to it.

Most research in humanistic environmental studies, including ecocriticism, has so far focussed on the role of social and cultural factors in generating and potentially countering ecosocial ills. This has been a broadly utopian project, inspired by the hope that crisis could be prevented from sliding into catastrophe, and bent instead towards ecosocial transformation. Today, as we are faced with the necessity of learning to live with a range of highly disruptive and only partially predictable climate change impacts, including the escalation of extreme weather events, literature may become a crucial tool in furthering disaster-preparedness.

Many people believe that we are "doomed" because of climate change. I reject this pessimism. Self interested people and firms who anticipate a threat have strong incentives to protect themselves through a broad set of strategies. Of course carbon pricing is the first best strategy but that ain't going to happen at the national or international level.

I just received this email that suggests that literature may help us to adapt to climate change. This claim may be true. Curious about what in the heck is the basis for her claim, I found this podcast of hers. I have not listened to it.

CONFRONTING CATASTROPHE

ECOCRITICISM IN A WARMING WORLD

A Talk by Kate Rigby

Professor of Comparative Literature and Cultural Studies

Monash University, Melbourne

Thursday, November 15, 5–6:30pm

UCLA Humanities Building 193

ECOCRITICISM IN A WARMING WORLD

A Talk by Kate Rigby

Professor of Comparative Literature and Cultural Studies

Monash University, Melbourne

Thursday, November 15, 5–6:30pm

UCLA Humanities Building 193

Most research in humanistic environmental studies, including ecocriticism, has so far focussed on the role of social and cultural factors in generating and potentially countering ecosocial ills. This has been a broadly utopian project, inspired by the hope that crisis could be prevented from sliding into catastrophe, and bent instead towards ecosocial transformation. Today, as we are faced with the necessity of learning to live with a range of highly disruptive and only partially predictable climate change impacts, including the escalation of extreme weather events, literature may become a crucial tool in furthering disaster-preparedness.

The Rise of Environmental and Urban Economics

My friend Holger Sieg delivers an excellent undergraduate lecture at the Univ. of Penn highlighting why environmental and urban economics is such an exciting research field. I would like to co-teach that course with him!

The Long Island Power Authority as a Complacent Government Monopolist

Competition is good. While it creates anxiety and it isn't cool, competition nudges us to raise our game. If you don't believe me, then read this NY Times article about the monopolist LIPA's lack of preparation for Hurricane Sandy.

Here is a quote from the article.

"In many ways, the Long Island Power Authority, known as LIPA, reflects the shortcomings of the state’s quasi-independent public authorities, which are often criticized as a shadow government that resists scrutiny. Long Island is the only region of New York where the main electrical utility is run by the government."

While the word "monopolist" isn't used in the article, it is clear that LIPA offers high pay/low work jobs for public employees who work for it. There is no market pressure and no incentive to engage in costly effort such as trimming trees to reduce power outage risk.

Here is a quote from the article.

"In many ways, the Long Island Power Authority, known as LIPA, reflects the shortcomings of the state’s quasi-independent public authorities, which are often criticized as a shadow government that resists scrutiny. Long Island is the only region of New York where the main electrical utility is run by the government."

While the word "monopolist" isn't used in the article, it is clear that LIPA offers high pay/low work jobs for public employees who work for it. There is no market pressure and no incentive to engage in costly effort such as trimming trees to reduce power outage risk.

"The examination by The Times shows that the Long Island Power Authority has repeatedly failed to plan for extreme weather, despite extensive warnings by government investigators and outside monitors. In fact, before Hurricane Sandy, the authority was significantly behind on perhaps the most basic step to prepare for storms — trimming trees that can bring down power lines.

Customers have been exasperated not only by a lack of power, but also by the authority’s inability to communicate basic information. Long Islanders have recounted tales of phones unanswered at authority offices, of wildly inaccurate service maps and of broken promises to dispatch repair crews."

Starbucks doesn't make these mistakes because it faces competition. It would lose all of its customers if it acted in a similarly complacent way. All hail competition!

"Hard" and "Soft" Investments to Protect Against the Next Storm Called Sandy

The WSJ previews some different investment options for coastal cities in the face of natural disaster risk. Note the search for solutions! Don't forget Julian Simon's optimism that a larger population offers more possible good ideas. Note the debate between the "hard" engineers who advocate investments in Sea Walls and the naturalists who advocate land set asides for wetlands and other "soft" investments. Who is right? How will these possible solutions be vetted?

From the perspective of intermediate micro, we need to know what is the marginal productivity of each of these investments in terms of reducing storm risk and what is the price tag on each of these proposed solutions? With this information, one can calculate "bang per buck" and rank these projects. If there are synergies between these projects then this will add complications but this is the rational approach to playing defense. Now, the interesting issue is how to finance these investments.

In typical intermediate micro, we know the production function (because the professor assumed it). For example, a typical pizza production would be; pizza = 40*square root of Labor. So, if a firm hires 100 laborers, it produces 400 pizza. Note the certainty in this case. We understand this production function and there are no shocks and no "fat tail" risk. (i.e there is zero probability that you hire 100 workers and end up with 0 pizza produced).

But, in the case of providing safety for Manhattan what is the analogous "production function"? Hansen and Sargent's work on robustness is relevant here because we don't know really know what will be the shocks that take place in the future and how well the proposed solutions (the hard vs. the soft) can handle such shocks. In evaluating the "hard" versus "soft" safety investments, are either set more robust in the face of fat tail risk?

From the perspective of intermediate micro, we need to know what is the marginal productivity of each of these investments in terms of reducing storm risk and what is the price tag on each of these proposed solutions? With this information, one can calculate "bang per buck" and rank these projects. If there are synergies between these projects then this will add complications but this is the rational approach to playing defense. Now, the interesting issue is how to finance these investments.

In typical intermediate micro, we know the production function (because the professor assumed it). For example, a typical pizza production would be; pizza = 40*square root of Labor. So, if a firm hires 100 laborers, it produces 400 pizza. Note the certainty in this case. We understand this production function and there are no shocks and no "fat tail" risk. (i.e there is zero probability that you hire 100 workers and end up with 0 pizza produced).

But, in the case of providing safety for Manhattan what is the analogous "production function"? Hansen and Sargent's work on robustness is relevant here because we don't know really know what will be the shocks that take place in the future and how well the proposed solutions (the hard vs. the soft) can handle such shocks. In evaluating the "hard" versus "soft" safety investments, are either set more robust in the face of fat tail risk?

A Few More Thoughts About California's AB32 and Carbon Cap & Trade

This Yale piece is quite good. My recent AB32 webinar convinced me that there is great interest in the Cap & Trade field experiment that California is now launching. The challenging issue for research nerds is that there is no control group and there will be general equilibrium effects! In such a setting, how do we evaluate whether the experiment is a success or not? What "double difference" do you plan to do to estimate the "average treatment effect"? Nerds of the world, unite! and start to think about these hard questions.

Admissions Policy at UCLA

Tim Groseclose discusses regression coefficients in a letter to the UCLA Daily Bruin that relates to a study conducted by UCLA Law's Rick Sander. Here is a letter signed by 57 of my UCLA colleagues and here is Rick Sander's piece on UCLA undergraduate admissions. Here is Robert Mare's review of UCLA admissions.

What do I think? Watch my Youtube lectures and you won't find out!

What do I think? Watch my Youtube lectures and you won't find out!

Discrimination Against Environmental Economists?

I just downloaded a free copy of the National Academy Press's new book on climate change impacts. An impressive set of scholars participated but I don't see any academic economists on the following list. Why? Don't we know a thing or two about climate change's social and political stresses? Is the dark art of economics really so useless for studying behavioral change caused by climate change?

The cynic in me is slightly concerned that those who arranged for this analysis are aware that economists are optimistic people who believe that people and economies can "change their game" in the face of an anticipated but ambiguous threat. I hope that "doom and gloomers" didn't exclude the economists because they anticipated that we would cause trouble during the consensus process?

Again, I will read the NAP book and will blog about it but where are the economists? If we are the best social scientists, why weren't we invited to the party?

PS: I also see that no economists reviewed this document for NAP. That's ugly!

COMMITTEE ON ASSESSING THE IMPACTS OF CLIMATE CHANGE

ON SOCIAL AND POLITICAL STRESSES

JOHN D. STEINBRUNER (Chair), Professor of Public Policy, University of Maryland;

Director, Center for International and Security Studies at Maryland

OTIS B. BROWN, Director, Cooperative Institute for Climate and Satellites, North Carolina

State University

ANTONIO J. BUSALACCHI, JR., Director, Earth System Science Interdisciplinary Center,

University of Maryland; Professor, Department of Atmospheric and Oceanic Science

DAVID EASTERLING, Chief, Scientific Services Division, National Climatic Data Center,

National Oceanic and Atmospheric Administration, Asheville, NC

KRISTIE L. EBI, Consulting Professor, Department of Medicine, Stanford University

THOMAS FINGAR, Oksenberg–Rohlen Distinguished Fellow and Senior Scholar, Freeman

Spogli Institute for International Studies, Stanford University

LEON FUERTH, Distinguished Research Fellow, National Defense University; Research

Professor of International Affairs, George Washington University; Founder and Director,

Project on Forward Engagement

SHERRI GOODMAN, Senior Vice President, General Counsel, and Corporate Secretary, CNA

Analysis and Solutions, Alexandria, VA; Executive Director, CNA Military Advisory

Board

ROBIN LEICHENKO, Associate Professor, Department of Geography, Rutgers University

ROBERT J. LEMPERT, Director, Frederick S. Pardee Center for Longer Range Global Policy

and the Future Human Condition, RAND Corporation, Santa Monica, CA

MARC LEVY, Deputy Director, Center for International Earth Science Information Network,

Earth Institute, Columbia University

DAVID LOBELL, Assistant Professor, Environmental Earth System Science, Stanford

University; Center Fellow, Program on Food Security and the Environment, Stanford

University

RICHARD STUART OLSON, Director of Extreme Event Research and Professor, Department

of Politics and International Relations, Florida International University

RICHARD L. SMITH, Director, Statistical and Applied Mathematical Sciences Institute,

Research Triangle Park, NC

Here is a direct quote listing the set of reviewers.

We wish to thank the following individuals for their review of this report: Marc F.

Bellemare, Sanford School of Public Policy, Duke University; Andrew Brown, Jr.,

Michigan/Innovation and Technology Office, Delphi Corporation, Troy; Jared L. Cohon,

Office of the President, Carnegie Mellon University; Geoff Dabelko, Environmental

Change and Security Program, Woodrow Wilson Center; Delores M. Etter, Caruth

Institute for Engineering Education, Southern Methodist University; John Gannon, BAE

Systems, Arlington, Virginia; James R. Johnson, (retired) Minnesota Mining and

Manufacturing Company, Oak Park Heights, Minnesota; John E. Kutzbach, Center for

Climatic Research, University of Wisconsin–Madison; Monty G. Marshall, Center for

Global Policy, George Mason University and Center for Systemic Peace, Societal-

Systems Research, Inc.; Dennis Ojima, Ecosystem Science and Sustainability, Warner

College of Natural Resources, Colorado State University; and Philip A. Schrodt,

Department of Political Science, Pennsylvania State University.

The cynic in me is slightly concerned that those who arranged for this analysis are aware that economists are optimistic people who believe that people and economies can "change their game" in the face of an anticipated but ambiguous threat. I hope that "doom and gloomers" didn't exclude the economists because they anticipated that we would cause trouble during the consensus process?

Again, I will read the NAP book and will blog about it but where are the economists? If we are the best social scientists, why weren't we invited to the party?

PS: I also see that no economists reviewed this document for NAP. That's ugly!

COMMITTEE ON ASSESSING THE IMPACTS OF CLIMATE CHANGE

ON SOCIAL AND POLITICAL STRESSES

JOHN D. STEINBRUNER (Chair), Professor of Public Policy, University of Maryland;

Director, Center for International and Security Studies at Maryland

OTIS B. BROWN, Director, Cooperative Institute for Climate and Satellites, North Carolina

State University

ANTONIO J. BUSALACCHI, JR., Director, Earth System Science Interdisciplinary Center,

University of Maryland; Professor, Department of Atmospheric and Oceanic Science

DAVID EASTERLING, Chief, Scientific Services Division, National Climatic Data Center,

National Oceanic and Atmospheric Administration, Asheville, NC

KRISTIE L. EBI, Consulting Professor, Department of Medicine, Stanford University

THOMAS FINGAR, Oksenberg–Rohlen Distinguished Fellow and Senior Scholar, Freeman

Spogli Institute for International Studies, Stanford University

LEON FUERTH, Distinguished Research Fellow, National Defense University; Research

Professor of International Affairs, George Washington University; Founder and Director,

Project on Forward Engagement

SHERRI GOODMAN, Senior Vice President, General Counsel, and Corporate Secretary, CNA

Analysis and Solutions, Alexandria, VA; Executive Director, CNA Military Advisory

Board

ROBIN LEICHENKO, Associate Professor, Department of Geography, Rutgers University

ROBERT J. LEMPERT, Director, Frederick S. Pardee Center for Longer Range Global Policy

and the Future Human Condition, RAND Corporation, Santa Monica, CA

MARC LEVY, Deputy Director, Center for International Earth Science Information Network,

Earth Institute, Columbia University

DAVID LOBELL, Assistant Professor, Environmental Earth System Science, Stanford

University; Center Fellow, Program on Food Security and the Environment, Stanford

University

RICHARD STUART OLSON, Director of Extreme Event Research and Professor, Department

of Politics and International Relations, Florida International University

RICHARD L. SMITH, Director, Statistical and Applied Mathematical Sciences Institute,

Research Triangle Park, NC

Here is a direct quote listing the set of reviewers.

We wish to thank the following individuals for their review of this report: Marc F.

Bellemare, Sanford School of Public Policy, Duke University; Andrew Brown, Jr.,

Michigan/Innovation and Technology Office, Delphi Corporation, Troy; Jared L. Cohon,

Office of the President, Carnegie Mellon University; Geoff Dabelko, Environmental

Change and Security Program, Woodrow Wilson Center; Delores M. Etter, Caruth

Institute for Engineering Education, Southern Methodist University; John Gannon, BAE

Systems, Arlington, Virginia; James R. Johnson, (retired) Minnesota Mining and

Manufacturing Company, Oak Park Heights, Minnesota; John E. Kutzbach, Center for

Climatic Research, University of Wisconsin–Madison; Monty G. Marshall, Center for

Global Policy, George Mason University and Center for Systemic Peace, Societal-

Systems Research, Inc.; Dennis Ojima, Ecosystem Science and Sustainability, Warner

College of Natural Resources, Colorado State University; and Philip A. Schrodt,

Department of Political Science, Pennsylvania State University.

Hurricane Sandy's Impact on Municipal Bond Market Spreads

To rebuild a damaged area requires large capital investments. Who finances these investments and what interest rate do they expect to be paid for lending their capital? What role do the ratings agencies such as S&P and Moody's play here? After Sandy, if Standard and Poors gives a coastal New Jersey town a bond rating of C, how large an interest rate premium will such a city have to pay to rebuild? Is that fair? Gretchen Morgenson's piece is worth reading. Should the national government guarantee the local bonds in order to allow the shocked cities to borrow at a lower interest rate or does that create moral hazard again?

Switching topics; look to the right of this blog entry --- you will see all 13 of my Youtube environmental economics lectures. As I add more, they will be included in the playlist to the right.

Switching topics; look to the right of this blog entry --- you will see all 13 of my Youtube environmental economics lectures. As I add more, they will be included in the playlist to the right.

Durable Urban Capital in Natural Disaster Zones

The Atlantic has a subtle piece about this topic. My parents live in Manhattan. My father teaches at NYU. My brother and his family live in an at risk part of New Jersey. While I feel great altruism for my family, I want firms, households and local governments to have the right incentives to build in relatively safe locations and to build resilient communities. Incentives matter. If people love coastal life, or if they are blissfully unaware "Homer Simpsons", then we must nudge them to higher ground through zoning codes, differential insurance pricing and the prospects of tough love no Federal bailouts via FEMA.

We are always rebuilding our cities. I don't believe path dependency arguments that just because Southern Manhattan has always been a center of activity, it should always remain so. Las Vegas was built over 20 years. We have shown an ability to build new cities quickly. Keynesians should embrace this!

The opposite dynamic also exists. When we regret past buildups of housing infrastructure (see Buffalo and Detroit), the population flees and home prices fall sharply. The loser are the original land owners who paid too much (ex-post) for the asset but the footloose migrants have moved elsewhere. Glaeser and Gyourko's 2005 paper on durable capital is highly relevant here. Migration breaks the link between shocks to places and people. We need to be nimble and resilient. For those who are neither nimble nor resilient then they better hope that the entrepreneurs have a technological fix (such as backup power generation, floatable homes) to help them. This was discussed at length in my 2010 Climatopolis.

We are always rebuilding our cities. I don't believe path dependency arguments that just because Southern Manhattan has always been a center of activity, it should always remain so. Las Vegas was built over 20 years. We have shown an ability to build new cities quickly. Keynesians should embrace this!

The opposite dynamic also exists. When we regret past buildups of housing infrastructure (see Buffalo and Detroit), the population flees and home prices fall sharply. The loser are the original land owners who paid too much (ex-post) for the asset but the footloose migrants have moved elsewhere. Glaeser and Gyourko's 2005 paper on durable capital is highly relevant here. Migration breaks the link between shocks to places and people. We need to be nimble and resilient. For those who are neither nimble nor resilient then they better hope that the entrepreneurs have a technological fix (such as backup power generation, floatable homes) to help them. This was discussed at length in my 2010 Climatopolis.

The University of Chicago's Economists Debate About the State of the Macroeconomy

John Cochrane and Austan Goolsbee held a debate on economic policy last week. Here are Cochrane's opening remarks. To paraphrase the Beatles, "All you Need is 4% Growth". Forget love, we need growth. Last year, the Clark Medalist President George W. Bush wrote the forward for a book that claims it has the secret recipe for achieving 4% GNP growth.

How do you unlock the full potential of an individual, a nation or a world economy? Jim Heckman is working away on how we build productive young adults. But, once we all graduate from Perry pre-School and we are 25 years old --- what type of national and world economy await us?